What is the difference between Cash Discount and Surcharge?

While both strategies help offset the cost of accepting credit cards, they operate in opposite directions in terms of pricing. They also both have different Rules and Regulations that must be followed.

Cash Discount is when you post credit card prices at a premium to offset credit card processing costs and offer a discount on that prices for customers who pay with cash.

Surcharge is a fee added to a credit card transaction to offset credit card processing costs. The customer pays more than the advertised price for paying with a credit card. If you're adding a fee at the register, whether you call it a "Non-cash Adjustment" or a "Non-cash fee", it is a surcharge.

.png?width=492&height=277&name=CASH%20DISCOUNT%20vs%20SURCHARGING%20(5).png)

Rules and Regulations

Cash Discount |

|

Surcharging |

||

|

|

Proper Signage Signage must be posted at the Point of Sale clearly stating Cash Discount is available. Posted price must reflect the credit card price. |

|

|

Proper Signage Surcharge fees must be disclosed at the Point of Sale and Point of sale, both in store and online. |

|

Determine the % Industry has adopted between 3-4% to cover card processing costs |

|

|

Determine the % As of 2023, Visa capped surcharges at 3% with other card brands likely to follow suit |

|

Receipts Ensure cash discount is clearly identified on receipt |

|

|

Receipts Ensure surcharge is clearly identified on receipt |

|

Card Brand Registration No registration required |

|

|

Card Brand Registration Some card brands require 30 days advanced notice before you begin surcharging |

|

Card Type Limitations No card type limitations |

|

|

Card Type Limitations Cannot be applied to:

|

|

Legal in all 50 states |  |

Not Legal in All 50 states As of 2023 surcharge is not legal in Connecticut, Maine, Massachusetts, and Oklahoma |

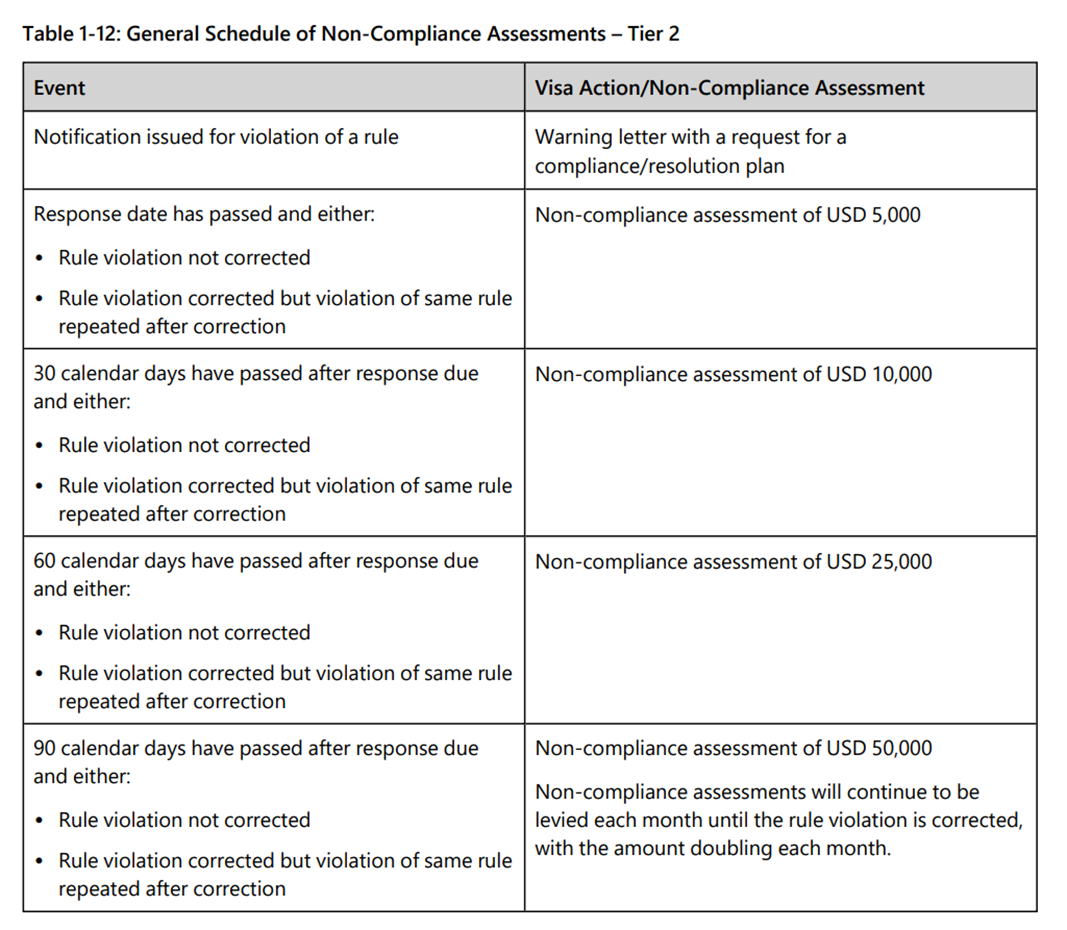

Penalties

If either of these programs are implemented without following the card brand regulations, they run the risk of being fined by the card brands.

Visa Violation Process

Still Have Questions?

We're here to help.